Did the Philippine construction industry reach new heights during the first half of 2024?

Undoubtedly, the Philippine construction industry is experiencing a period of robust growth, driven by a combination of government infrastructure initiatives, such as the current administration’s Build, Better, More program, and an increase in public-private partnerships (PPPs) supported by the private sector.

The industry is dynamic and thriving, creating new opportunities for Filipino construction workers and offering better business ventures for construction companies of all sizes.

However, where there is business there is also competition, and big players in the local construction industry are vying to dominate the landscape. Let’s look at the key industry statistics below:

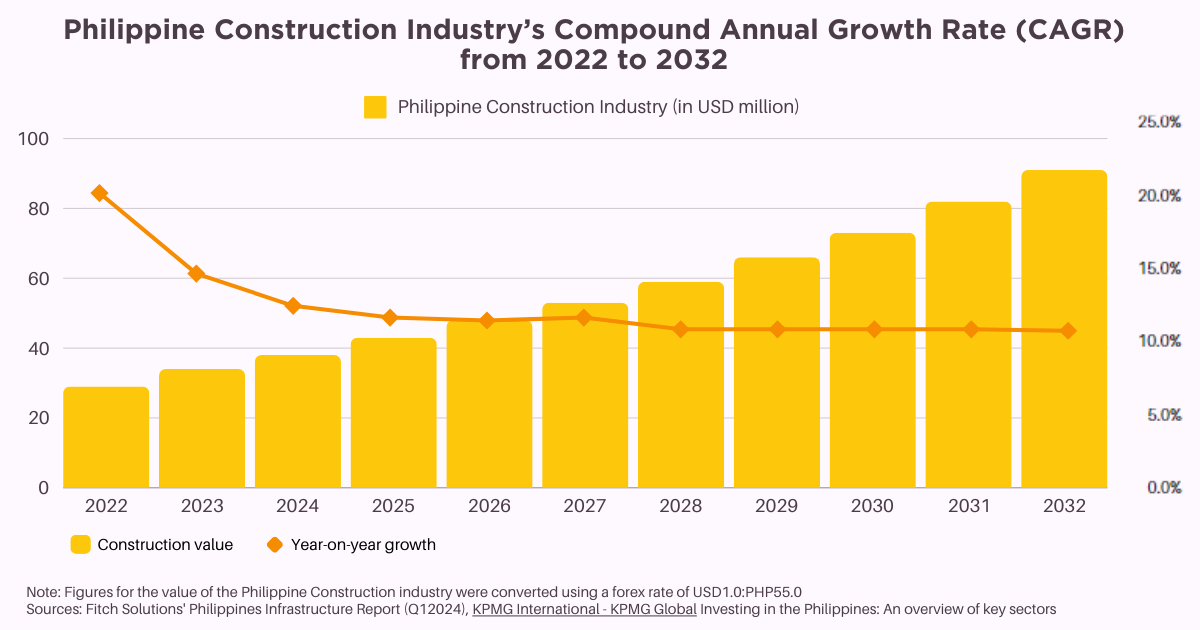

Industry Forecast for 2025-2032

The Philippine construction industry is expected to grow at a CAGR of 11.5%, from $38 billion in 2024 to $91 billion in 2032. (KPMG International – KPMG Global). This data indicates that the local construction industry is projected to maintain a steady growth rate until at least 2031.

Government infrastructure projects account for a significant portion of construction activity, with the Build Build Build program driving investments in roads, bridges, railways, flood control projects, and other infrastructure.

To understand the current state of the industry and key players’ performance, let’s review the H1 2024 results for three major construction firms: Concrete Aggregates, EEI, and MegaWide.

Representing different market segments, these three companies highlight broader industry trends. Analyzing their performance can help us identify key trends, challenges, and future growth prospects for the Philippine construction industry.

Overview of the Construction Industry for H1 2024

In the first half of 2024, the Philippine construction sector saw a mix of growth opportunities and challenges. Boosted by large-scale government infrastructure projects, the industry remains one of the biggest drivers of the country’s economic progress, accounting for 16% of the country’s 6.3% GDP growth during the second quarter of 2024. (Philippine Statistics Authority)

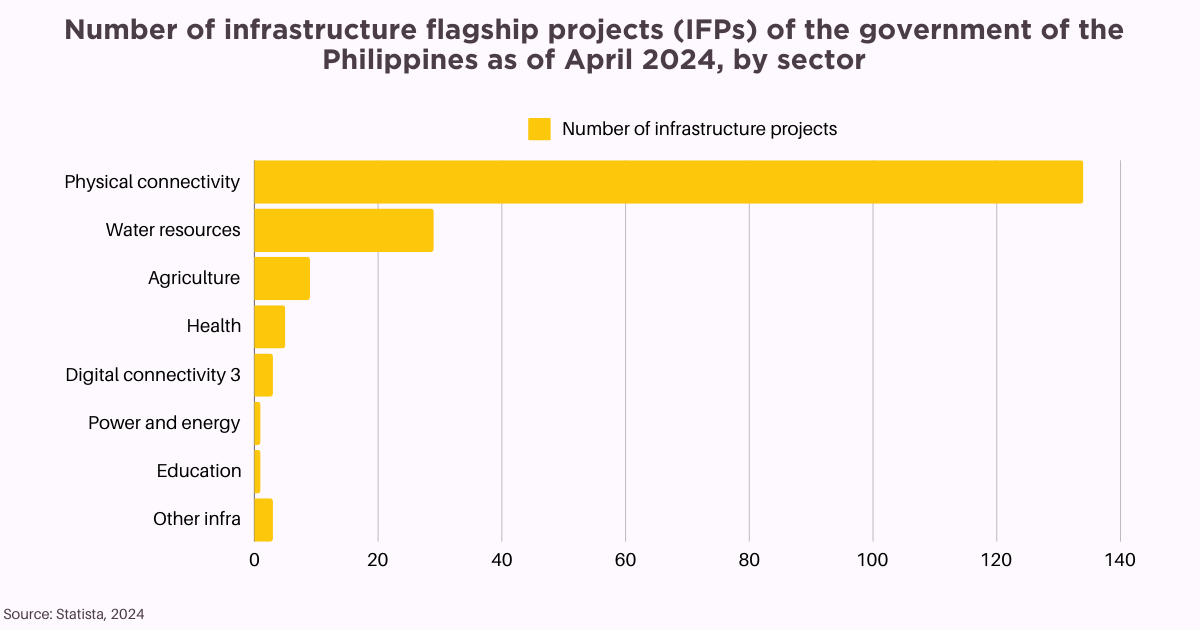

Government projects continue to pave the way for numerous public works while rising investments in renewable energy and transportation infrastructure highlight future growth areas. Projects focusing on physical connectivity continue to represent the largest portion of the country’s IFPs.

As of April 2024, there are 185 projects under the infrastructure development program. However, global economic factors, such as fluctuating material costs and supply chain disruptions, have introduced uncertainties. Additionally, local companies are constantly expressing enthusiasm for leveraging technological advancements within the industry.

According to an industry report by Procore Technologies, Inc., 65% of the 259 construction consultancy firms have increased their digital investments in innovative construction technologies, with precast concrete, automation, and sustainable construction methods becoming more prevalent.

Concrete Aggregates

Image from Concrete Aggregates Corp.

Company Profile

Concrete Aggregates Corporation (CA) has been a fixture in the Philippine construction materials sector since its incorporation in 1959. With a focus on supplying aggregates, ready-mix concrete, and other essential materials, CA’s operations are critical to many major infrastructure projects.

Industry Pulse and Key Company Developments

- Crisis Impact: The company experienced significant setbacks during the 1998 economic crisis, leading to the closure of its Engineering and Construction Division in 1999. This affected its RMC, BCM, concrete products, and construction operations.

- Restructuring: In 2008, CA shifted focus by incorporating Batong Angono Aggregates Corporation (BAAC), which took over quarry operations. CA now earns revenue through royalty payments from BAAC (now Helix Aggregates Inc.), allowing it to focus on core aggregate supply.

Recent Key Financial Highlights

Strong growth in key financial metrics for the past two years shows a recovery trend:

| Net sales revenue | + 38.43% |

| Operating profit (EBIT/Earnings Before Interest and Taxes) | + 46.23% |

| EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) | + 45.87% |

| Net Profit | + 32.47% |

| Total Assets | + 3.05% |

| Operating Profit Margin | + 3.98% |

| Net Profit Margin | – 2.82% |

| Quick Ratio | – 1.61% |

| Cash Ratio | – 2.56% |

Source: Emerging Markets Information Service

Concrete Aggregates shows mixed financial health. While revenue and profitability indicators improved, liquidity ratios weakened. These figures suggest that CA’s operational model, which involves receiving significant contributions from royalty income, has provided stability but may need tighter financial management to counter profitability pressures.

MegaWide

Image from NegoSentro/MegaWide

Company Profile

MegaWide Construction Corporation is a leading Philippines-based construction and infrastructure development company. Established in 1997, MegaWide has built a strong reputation for delivering high-quality and innovative construction solutions. The company specializes in various sectors, including transport infrastructure, residential, commercial, and industrial projects. MegaWide’s expertise extends to both large-scale and specialized projects, with a focus on integrating advanced construction technologies and sustainable practices.

Industry Pulse and Key Company Developments

- In the first half of 2024, Megawide Construction Corp. reported a notable 21% increase in net income, rising to ₱438 million from ₱362 million in H1 2023. This growth reflects the sustained strength of its construction operations, which remain the company’s primary revenue driver, contributing 95% of total revenues with ₱10.9 billion.

- MegaWide’s total revenues for the period reached ₱11.4 billion, a 2% growth year-on-year. The company’s real estate operations, consolidated under PH1 World Developers Inc., contributed ₱311.1 million, marking its initial attempt into this sector and reflecting 100% growth due to the newly launched operations. This diversification positions MegaWide for future expansion, particularly in the affordable housing market.

In 2024, MegaWide will continue to make significant strides in the construction industry with several key projects, including:

- Metro Manila Subway Project: A major infrastructure development aimed at enhancing urban transit and reducing congestion.

- Mactan-Cebu International Airport Terminal 2: An expansion project designed to boost capacity and improve passenger experience.

- Parañaque Integrated Terminal Exchange (PITX): a public transport terminal in Parañaque, Metro Manila, Philippines.

- Clark International Airport Passenger Terminal Building: a newly built terminal building to enhance the logistics of the airport and the comfort of the passengers.

MegaWide remains committed to excellence and innovation, driving growth and infrastructure development across the Philippines.

Recent Key Financial Highlights

| Net Sales Revenue | + 19.41% |

| Total Operating Revenue | + 16.24% |

| Operating Profit (EBIT/Earnings Before Interest and Taxes) | + 242.1% |

| EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) | + 71.95% |

| Total Assets | + 7.11% |

| Total Equity | – 8.26% |

| Operating Profit Margin (ROS) | + 8.16% |

Source: Emerging Markets Information Service

MegaWide’s construction operations, benefitting from government-led infrastructure projects, saw substantial growth in its order book, which now stands at ₱48 billion, equivalent to two to three years’ worth of revenue.

The company’s pre-cast and construction solutions (PCS) segment also posted impressive results, with revenues growing by 150% to ₱1.9 billion. This segment is expected to play a larger role in future revenue generation due to its higher margins and scalability.

With the ongoing expansion of its project portfolio, MegaWide plans to maintain a healthy annual order book of ₱40 billion to ₱45 billion and has expressed interest in bidding for additional large-scale government infrastructure projects, including the Cavite-Bataan bridge and the fourth Mactan bridge.

EEI Corp.

Company Profile

EEI Corporation is a prominent engineering, procurement, and construction (EPC) company in the Philippines. The company is renowned for its extensive expertise and successful track record in the construction industry. Established in 1931, EEI has become a leader in delivering complex and large-scale projects across various sectors, including energy, infrastructure, industrial, and commercial construction.

EEI has a broad range of services that includes engineering design, procurement, construction, and project management. The company also puts a focus on sustainable practices and cutting-edge technology.

Industry Pulse and Key Company Developments

In the first half of 2024, EEI Corporation has demonstrated a strong performance with notable achievements and strategic initiatives. The company secured a significant ₱1.79 billion contract for the construction of the CAVITEX-CALAX Link, a vital 1.2 km connector road in Southern Tagalog. This project is set to enhance regional connectivity by reducing travel time between Cavite and Laguna. Additionally, EEI is engaged in major railway projects across the country (Metro Rail Transit Line 7 (MRT-7) and the Metro Manila Subway), contributing to a robust project pipeline.

EEI has also signed a memorandum of understanding with Concrete Stone Corp. (CSC) to address its precast concrete needs. This collaboration is aimed at ensuring a steady supply of high-quality materials, which is expected to streamline infrastructure development across Luzon, Visayas, and Mindanao.

EEI holds a quadruple-A rating from the Philippine Contractors Accreditation Board (PCAB), underscoring its top-tier status in the construction industry. The company’s international reach, with collaborations in the Middle East, Africa, and Asia Pacific, further enhances its reputation and demonstrates its world-class project management capabilities.

Recent Key Financial Highlights

| Net Sales Revenue | + 4.23% |

| Total Operating Revenue | + 10.02% |

| Total Assets | + 9.97% |

| Debt-to-Equity Ratio | + 19.41% |

*Key metrics such as Net Profit Margin and EBITDA are not available.

Source: Emerging Markets Information Service

EEI Corporation has maintained its competitive edge through ongoing investments in technological and safety advancements. Additionally, the company wants to put emphasis on its commitment to excellence with updated certifications in quality, environmental management, and safety standards (ISO 9001, 14001, and 45001).

EEI’s involvement in high-profile projects like the CAVITEX-CALAX Link and mega railway systems illustrates its dominant role in the Philippine infrastructure industry. The company’s partnerships and technological advancements position it well to contribute to the growing demand for connectivity and urban development in the Philippines.

Financially, EEI demonstrates operational resilience, though profitability concerns remain. Its strategic collaborations with suppliers like CSC and its ability to secure substantial contracts reflect its adaptability in a competitive market.

These factors, alongside its continued focus on technological innovation and commitment to safety, showcase EEI as a company set to remain a key player in the Philippine construction industry, but with challenges in profitability that will require close monitoring in the coming periods.

Charting the Future: Insights and Prospects for the Philippine Construction Industry in H1 2024

As we conclude our analysis of the Philippine construction industry for the first half of 2024, it’s clear that the sector is navigating through a transformative phase. The combined impact of the government’s Build, Better, More program and an upsurge in public-private partnerships has significantly changed the industry—and it will continue to do so in the foreseeable future.

Concrete Aggregates, with their resilience and adaptation in a changing economic landscape, underscore the sector’s capacity for recovery and stability. MegaWide’s notable performance and strategic expansion into diverse project segments highlight the potential for sustained growth and innovation in the country. Meanwhile, EEI Corporation’s strategic partnerships affirm its pivotal role in infrastructure development, despite facing profitability challenges.

Looking ahead, the industry is poised for continuous expansion, driven by government projects and increased investments in innovative practices. This includes initiatives supported by foreign investments and public-private partnerships. However, the industry must remain agile to address global economic uncertainties and competition arising from international affairs, crises, and conflicts.

The coming years will be crucial as the sector adapts to these dynamics, striving to solidify its role as a cornerstone of economic growth and infrastructure advancement in the Philippines.

This is the first part of our Construction Industry Pulse H1 2024 series. Subscribe now to be notified of the upcoming installments: Part 2: Construction Retailers and Part 3: Real Estate.

References:

Balita, C. (2024, July 11). Philippines: government infrastructure projects by sector 2024. Statista. Retrieved September 12, 2024, from https://www.statista.com/statistics/1479568/philippines-number-infrastructure-projects-government-by-sector/

Concrete Aggregates Corporation (CA. (n.d.). DISCLOSURES. Concrete Aggregates Corporation (CA. https://www.cac.com.ph/quarterlyreports.html

EMIS. (n.d.). Megawide Construction Corporation (Philippines). EMIS. https://www.emis.com/php/company-profile/PH/Megawide_Construction_Corporation_en_3222370.html

EMIS. (2024, July 15). Concrete Aggregates Corporation Company Profile – Philippines | Financials & Key Executives. EMIS. Retrieved September 12, 2024, from https://www.emis.com/php/company-profile/PH/Concrete_Aggregates_Corporation_en_12829477.html

Globe Newswire. (n.d.). Philippines Construction Industry Report 2024: Output to Expand by 7% in Real-terms this Year, Driven by Increase in Total Approved Foreign Investments in Energy and Infrastructure – Forecast to 2028. Yahoo!Finance. https://finance.yahoo.com/news/philippines-construction-industry-report-2024-095600347.html

Mercurio, R. (n.d.). Construction bolsters Megawide’s H1 income. PhilStar. https://www.philstar.com/business/2024/08/16/2378133/construction-bolsters-megawides-h1-income

Mercurio, R. (2024, July 7). Megawide expects real estate venture to flourish next year. Philippine Star. Retrieved September 12, 2024, from https://www.philstar.com/business/2024/07/07/2368249/megawide-expects-real-estate-venture-flourish-next-year

PSE Edge. (n.d.). Company Information. PSE Edge. Retrieved September 12, 2024, from https://edge.pse.com.ph/companyInformation/form.do?cmpy_id=213