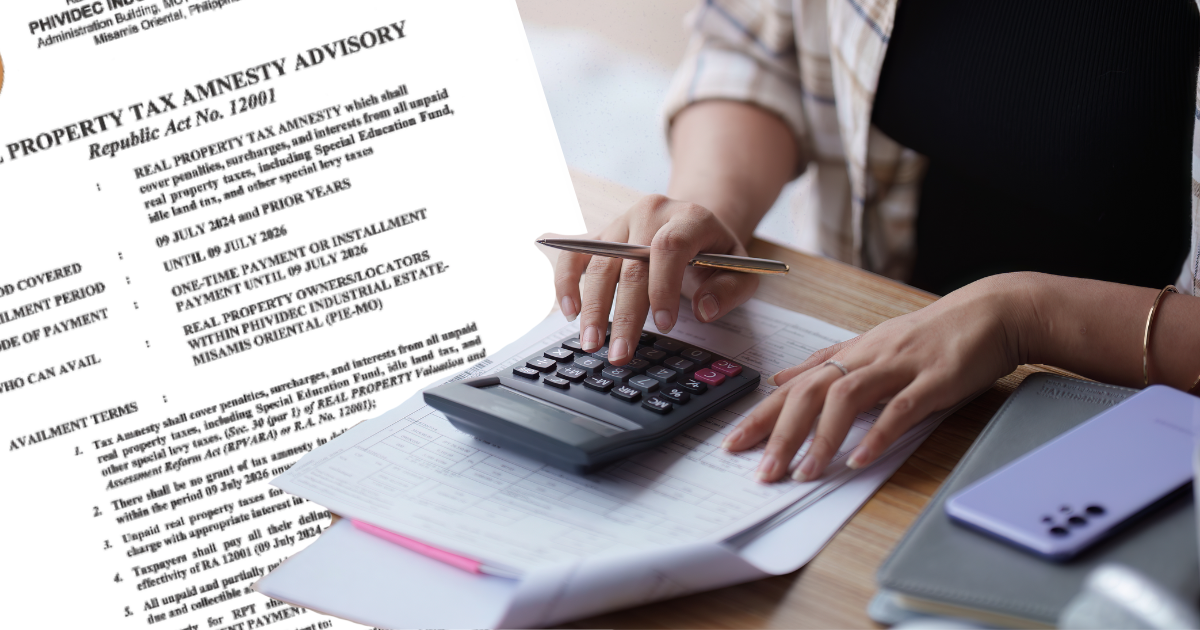

In July 2024, a significant opportunity became available for property owners in the Philippines. Republic Act No. 12001 introduced the Real Property Tax Amnesty, offering much-needed relief to those with unpaid taxes, penalties, surcharges, and interest.

The amnesty period, which runs from July 9, 2024, to July 9, 2026, gives property owners the chance to settle their outstanding tax obligations without incurring additional financial strain. This nationwide tax relief program provides a second chance for owners to resolve their tax issues before it ends. In this article, we’ll discuss essential details about the tax amnesty period and how you can take full advantage of this opportunity.

What is Real Property Amnesty?

The Real Property Tax Amnesty is a government initiative designed specifically to ease the burden of unpaid taxes for Filipino property owners. This program provides relief by allowing property owners to settle outstanding debts without facing high penalties and interest. It covers several taxes, including:

- Special Education Fund

- Idle Land Tax

- Other special levies

These taxes are often difficult for property owners to manage, making the amnesty a timely opportunity to get tax records in order and reduce financial stress.

Key Provisions and Changes Under the New Law

Under Republic Act 12001, property owners with delinquent taxes as of July 2024 can take advantage of a special amnesty, but they must act within a two-year window, from July 9, 2024, to July 9, 2026. This timeframe provides ample opportunity for property owners to settle their outstanding dues, either through a one-time payment or by opting for the more flexible installment plan. This option is particularly beneficial for those who may not have the full amount available upfront.

Taxpayers should be aware that properties with unresolved delinquencies after July 9, 2026, will no longer qualify for this amnesty. Instead, they will be subject to the standard penalties, surcharges, and interest rates that apply before the amnesty period. We specifically designed this amnesty to provide financial relief to certain taxpayers, making it crucial to take advantage of this limited opportunity. Settling all tax delinquencies within the designated time frame is key to fully benefiting from the temporary relief on offer.

Benefits of the Real Property Amnesty

The new Real Property Amnesty law offers several advantages for property owners. Here’s a breakdown of the key benefits:

1. Financial Relief

One of the most significant benefits of the tax amnesty law is the financial relief it provides. This law allows for the reduction or even elimination of penalties that would typically accumulate over time. As a result, property owners can save substantial amounts of money, which is especially beneficial for those with outstanding tax debts.

Key points to consider:

- The law offers a chance to reduce or eliminate penalties.

- Property owners can save significant amounts of money.

- The amnesty serves as an incentive to settle tax obligations and avoid future penalties.

This opportunity encourages individuals to resolve their debts now, preventing additional financial burdens in the future.

2. Simplified Tax Payment Process

The law also simplifies the current tax payment process. Property owners have the flexibility to either pay in a lump sum (complete, single payment) or spread payments (installments) over time, depending on what is most comfortable or possible in each person’s financial situation. This flexibility makes it easier for them to manage and settle their tax liabilities.

3. A Fresh Start

Perhaps the most significant advantage is the opportunity for a fresh start for property owners. The Real Property Amnesty allows owners to clear up most or all of their past property debts, all aligned with local tax laws while improving overall compliance.

Taking advantage of this opportunity not only helps taxpayers avoid potential legal complications but also positions them for a stronger financial future.

Limitations and Exclusions of the Real Property Tax Amnesty

While the Real Property Tax Amnesty offers valuable relief, it’s important to know that not all properties qualify. Some exclusions include:

- Properties already sold at public auction.

- Properties under existing compromise agreements.

- Properties involved in ongoing court cases.

Additionally, property owners must settle taxes for the current year to avoid accumulating penalties.

Moving Forward: Seize the Opportunity

The Real Property Tax Amnesty is truly a golden opportunity for property owners to get back on track with their finances and responsibilities. If you’re dealing with unpaid taxes or past penalties, this amnesty offers a way out with less financial strain. However, it’s important to act before the July 2026 deadline to take full advantage of the benefits.

For those looking to clear their tax liabilities, now is the time to get in touch with local authorities for detailed instructions on how to get the amnesty. Don’t wait until it’s too late—grab this chance to reduce your lingering financial burdens!