How has the construction retail sector fared in the face of the economic shifts and market changes in the first half of 2024?

As the Philippine construction industry navigates fluctuating economic conditions and evolving consumer demands, construction retail companies face both significant challenges and promising opportunities.

Current forecasts about the construction industry place the retail sector in an advantageous position. Despite economic shifts and industry changes, the construction retail sector continues to demonstrate notable resilience and adaptability, with trends indicating a steady demand for construction materials and home improvement products, even amid a significant slowdown in construction material price growth.

This article is the second part of our Construction Industry Pulse H1 2024 Series. In this installment, we explore how leading construction retailers have responded to shifting market dynamics by analyzing their financial performance, strategic pivots, and operational adjustments.

Tara, ka-Builders! Let’s take a closer look at their journey and uncover the key factors that influenced their success in the first half of 2024.

Overview of the Construction Industry’s Retail Sector for H1 2024

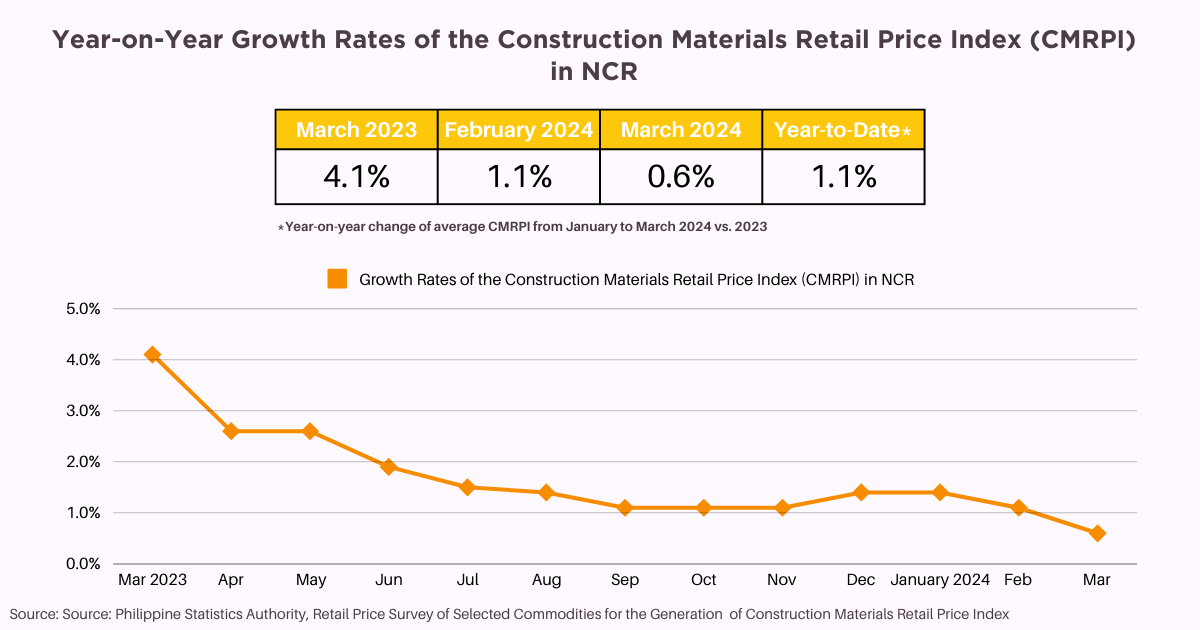

The construction materials retail price index (CMRPI) in Metro Manila showed a significant slowdown in growth by March 2024. Year over year, the index increased by 0.6%, a sharp decline from 4.1% in March 2023. This gradual deceleration continued from February 2024’s rate of 1.1%.

One of the primary reasons for the slower growth was a drop in the prices of key construction materials. For example, tinsmithry materials, which make up a substantial portion of construction costs, saw slower price increases, moving from 3.1% in February to 2.4% in March 2024.

Other categories, like electrical materials and painting supplies, also experienced smaller price hikes, while some materials, such as masonry and plumbing materials, even showed slight price declines. Interestingly, carpentry materials bucked the trend with a slight increase in price growth to 0.2%, up from 0.1% the previous month.

Overall, the data reflects a period of slowing construction costs, a trend that could offer some relief to developers and homeowners managing budgets in Metro Manila. Let’s explore how key construction retailer giants Wilcon and AllHome have adapted during the first half of 2024 and what their performance reveals about the future trajectory of the construction retail market.

Wilcon Depot Inc.

Image from Real Living/ Globe Internation Distributor Center Inc.

Company Profile

Wilcon Depot, Inc. is a leading home improvement and construction retail company in the Philippines. Established in 1977, Wilcon has built a strong reputation as a go-to destination for high-quality building materials, home improvement products, and furnishings.

The company operates a vast network of stores across the country, offering a comprehensive selection of products including tiles, sanitary ware, electricals, and hardware. Known for its commitment to providing top-notch products and exceptional customer service, Wilcon continues to be a prominent player in the Philippine construction retail market.

Industry Pulse and Key Company Developments

- Seasonal Factors: The timing of the Easter holidays, which fell in March this year compared to April last year, had a significant impact on sales. March, usually a high-grossing month, saw a substantial drop in sales, affecting the overall performance for Q1 2024.

- Store Expansion: Wilcon continued its expansion by opening three new stores in the first quarter, including two DIW format branches and one Depot store. The company is on track with its expansion plans, having opened five new stores in H1 2024.

Recent Key Financial Highlights

| Net Sales |

|

| Net Income |

|

| Gross Margin | 39.8% |

Source: iTechSolutions

Despite a slight increase in H1 2024 net sales, the company experienced a decline in net income due to higher operating expenses and the impact of lower sales in March. The gross profit margin remained relatively stable, indicating that the company effectively managed the cost of goods sold.

Comparable sales declined in the Depot-format stores, which account for the majority of sales. Conversely, the DIW format stores experienced significant sales growth, though their overall contribution remains smaller.

Operating expenses increased significantly, driven by expansion-related costs such as depreciation and logistics. This increase in expenses outpaced sales growth, contributing to a decline in net income.

Wilcon plans to continue its expansion, aiming to reach 100 stores by the end of the year. The company is optimistic about recovering from the early-year sales dip and expects better performance in the latter half of 2024. Strategic initiatives, including targeted promotions and contractor programs, are expected to support this recovery.

AllHome Corp.

Image from Company Information/ Philippine Retailers Association

Company Profile

AllHome Corp. is a leading home improvement and construction supply retailer in the Philippines. Founded in 2009, the company operates a wide network of stores across the country, offering a comprehensive range of products, including building materials, home furnishings, and décor items.

Industry Pulse and Key Company Developments

- Recent industry developments indicate a shift towards online retailing, with consumers increasingly preferring e-commerce platforms for convenience. AllHome Corp. has responded to these trends by enhancing its digital presence and e-commerce capabilities to capture a broader market.

- The company has also undertaken significant expansion efforts, including the opening of new stores and the upgrading of existing locations to better meet customer needs. Consolidating its market position and addressing competitive pressures within the retail sector are the goals of these strategic moves.

- AllHome Corp. has been investing in technology and supply chain improvements to streamline operations and enhance the customer experience.

Recent Key Financial Highlights

Revenues: PHP 5.6 billion (H1-2024)

Net Income: PHP 282.4 million (H1-2024)

| Revenues |

|

| Cost of Goods Sold |

|

| Gross Profit |

|

| Other Income |

|

| Operating Expenses |

|

| Operating Profit |

|

| EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) |

|

| Profit Before Tax |

|

| Tax Expense |

|

| Net Income |

|

| Net Margin | 5.0% |

Source: AllHome 1H 2024 Results Briefing

AllHome Corp.’s financial performance in the first half of 2024 reflects a mixed landscape of challenges and steady operational aspects. The company’s revenues declined by 6.9%, reaching PHP 5.6 billion, which indicates a slowdown in sales. This drop in revenue is accompanied by a 7.4% decrease in the Cost of Goods Sold (COGS), suggesting a reduction in production or procurement costs, possibly due to lower sales volumes or adjustments in supply chain strategies.

The decreases in revenues and gross profit highlight a challenging period for AllHome, which is attributed to decreased sales in certain product categories and higher costs. However, the stable net margin of 5.0% indicates that despite declines in other areas, the company has maintained a moderate level of profitability.

Construction Industry Pulse for H1 2024: Wilcon & AllHome

The second installment of the Construction Industry H1 Pulse Series sheds light on AllHome and Wilcon Depot’s operational dynamics and strategic maneuvers in the first half of 2024. Both companies exhibit distinct approaches to leveraging market opportunities amidst fluctuating economic conditions.

The insights from this analysis reveal a sector characterized by adaptability and strategic foresight. AllHome and Wilcon Depot’s initiatives highlight the importance of innovation and operational excellence in navigating the current market landscape. These developments offer valuable lessons for stakeholders aiming to understand the impact of broader economic trends on industry performance.

Stay tuned for the third installment of the Construction Industry H1 Pulse Series, where we will explore the real estate sector. Our upcoming analysis will provide a deeper understanding of how real estate companies are maneuvering through the market’s complexities.

Don’t miss out on this series update, Ka-Builders!

This is the first part of our Construction Industry Pulse H1 2024 series. Subscribe now to be notified of the upcoming installments: Part 2: Construction Retailers and Part 3: Real Estate.

References

Construction Materials Retail Price Index in the National Capital Region (2012=100): March 2024. (2024, April 15). | Philippine Statistics Authority | Republic of the Philippines. Retrieved September 19, 2024, from https://www.psa.gov.ph/price-indices/cmrpi/node/1684063363

https://corporate.allhome.com.ph/. (n.d.). 1H 2024 Results Briefing. https://corporate.allhome.com.ph/. https://corporate.allhome.com.ph/wp-content/uploads/HOME-Investors-Briefing-1H2024.pdf

Inquirer Net. (n.d.). Wilcon Depot ends H1 with P1.8-B profit. Inquirer Net. https://business.inquirer.net/412579/wilcon-depot-ends-h1-with-p1-8-b-profit

iTechSolution. (n.d.). AllHome Corp. Turns in P5.6 Billion Revenue for H1-2024, P282.4 Million in NIAT. iTechSolution. https://www.itechsolutionph.com/blog/allhome-corp-turns-in-p56-billion-revenue-for-h1-2024-p2824-million-in-niat

iTechSolutions. (n.d.). Wilcon Depot, Inc. Reported Q2 2024 Net Sales of P8.9 Billion, Up 2.9% YoY; H1 2024 Gross Profit of P6.8 billion, 39.8% GPM. iTechSolutions. https://www.itechsolutionph.com/blog/wilcon-depot-inc-reported-q2-2024-net-sales-of-p89-billion-up-29-yoy-h1-2024-gross-profit-of-p68-billion-398-gpm

PhilStar. (n.d.). https://www.philstar.com/business/stock-commentary/2024/08/01/2374634/wilcon-q2-profit-p770m-down-10-yy. PhilStar. https://www.philstar.com/business/stock-commentary/2024/08/01/2374634/wilcon-q2-profit-p770m-down-10-yy

Wilcon Depot Inc. Investor Relations. (2024, May 6). COVER SHEET. Wilcon Depot Inc. Investor Relations. Retrieved September 19, 2024, from https://investor.wilcon.com.ph/contents/uploads/2024/05/WLCON-1Q2024-Earnings-PR.pdf